The CFO and CIO need to work together closely to ensure successful digital transformation. This partnership is critical to success because each plays an important role in an organization’s digital transformation. The CFO brings expertise in finance and budgeting while the CIO has expertise in technology. Together, they can develop a strategy that aligns financial goals with IT initiatives. This collaboration is essential for staying ahead of the competition and capitalizing on new opportunities.

FT Longitude surveyed CXOs from North America, Europe, the Middle East and Africa (EMEA), and Asia Pacific and Japan (APJ), to know the impact of both the finance and IT functions for finance digital transformation and why CFO-CIO alignment is critical to success.

Alignment gaps between finance and IT will undermine the digital finance opportunity

In 31% of organizations, finance and IT are not always aligned. 41% of CIOs do not have a seat during critical finance meetings. 42% CFOs and 19% of CIOs admit that their organization has yet to develop a digital finance transformation strategy. According to the survey, CFOs and CIOs are not aligned in three critical areas – data and insights, tools and technologies, and skills and capabilities. CFOs cite a lack of financial literacy skills within IT and CIOs cite a lack of technology and data skills within finance as top barriers to digital finance transformation.

Organizations that have low finance-IT alignment are behind on their digital finance transformation journey.

Need for a new CFO-CIO partnership

The role of the CFO has grown and changed recently. Now, in addition to financial metrics and goals, the CFO is responsible for providing strategic insights that help the whole organization be more agile and successful. To achieve this, the finance function needs to be transformed so it can provide better data and analytics. This will help organizations operate more effectively and attract top talent to finance positions.

- 51% of CFOs are increasingly reliant on non-financial data like ESG, operational, and customer information, to make financial decisions. Yet only 52% of CIOs agree that their organization has a single unified view of all financial, operational, and people data, essential for CFOs to exploit insights from both inside and outside the business.

- 54% of CFOs find their legacy enterprise resource planning (ERP) systems to be not flexible enough to meet the demands of the modern business environment. They are in favor of transitioning to next-gen cloud-based ERP systems. 53% of CFOs who want to modernize their legacy ERP systems, do not have time to do it.

- Talent is another area where the CFO-CIO partnership is critical. Both CFOs and CIOs want their teams to be better educated. The CFOs want the IT teams to have better financial skills, while the CIOs want the finance teams to have better technology skills and be able to understand data.

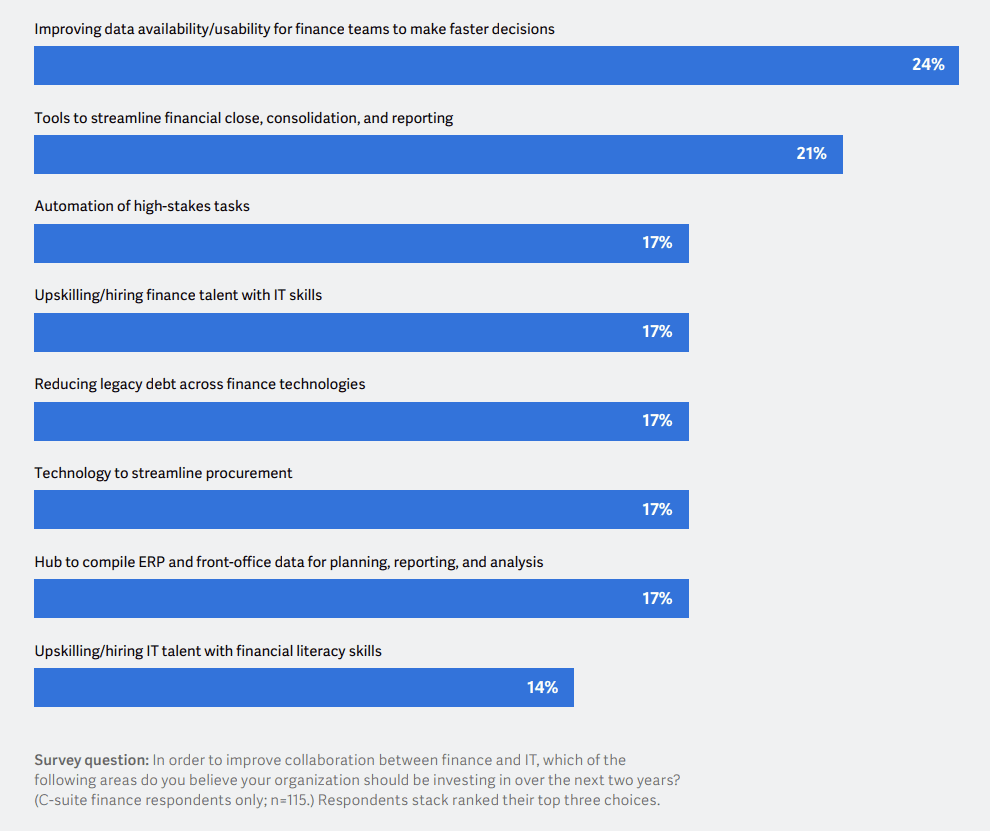

How can CFOs improve finance-IT collaboration?

- Provide finance teams with the data and insights they need.

Finance teams need accurate data to meet their transformation and business goals. They also need insights from that data. Improving data management is a top priority for CFOs and CIOs working together. To make sure that the data is accurate and usable, CFOs need to work with their IT counterparts to remove any barriers that might get in the way of data usability.

2. Align finance and IT with technology.

Even though technology is essential to solving business challenges, CIOs often do not have a seat at the finance table. This can be a problem because it limits the ability of the CIO to help improve the partnership between these two groups. Innovation, technology, and agility are important for this goal, and automation of manual tasks can play a major role in achieving operational efficiencies.

3. Update finance and IT teams with skills required for collaboration and change.

Giving finance leaders more opportunities to learn about new technologies will help them better understand CIOs and the things they are talking about. This will reduce any anxiety they feel about having to learn a new skill set.

At present, it has become important for the CFO and CIO to work together. Collaborating with IT can help finance departments quickly make the changes needed for them to go digital. This will help CFOs to attract the new talent they need to be more effective.

Source: Workday

Read next: Gartner lists top 8 cloud infrastructure and platform services providers in 2022 Magic Quadrant