Reserve Bank of India’s Account Aggregator Network

Backdrop

The much-awaited Account Aggregator (AA) network went live on September 2, 2021. The AA framework is based on the Data Empowerment and Protection Architecture (DEPA) which allows users to share their data through an independent consent management entity. The AA framework aims at making financial data more usable and accessible by allowing licensed participants to facilitate customers’ financial data transfer between the providers and users of such information.

As of the date of writing, the RBI has provided AA operating license to CAMS FinServ, Cookiejar Technologies, FinSec AA Solutions Private, and National e-Governance Services Asset Data. In addition to these, PhonePe, Perfios, and Yodlee, have received in-principle approval from the RBI. So far, banks like Axis Bank, IDFC, IndusInd, SBI, HDFC, ICICI, and Federal Bank have joined the framework.

Regulating entities and regulatory framework

The framework is governed by the Reserve Bank of India’s (RBI) Master Direction – Non-Banking Financial Company (NBFCs) – Account Aggregator (Reserve Bank) Directions, 2016. The four financial regulators- RBI, Securities and Exchange Board of India (SEBI), Pension Fund Regulatory and Development Authority of India (PFRDA), Insurance Regulatory and Development Authority of India (IRDAI) allow their respective regulated entities (REs) to share data through AAs after obtaining user consent.

How does an AA work?

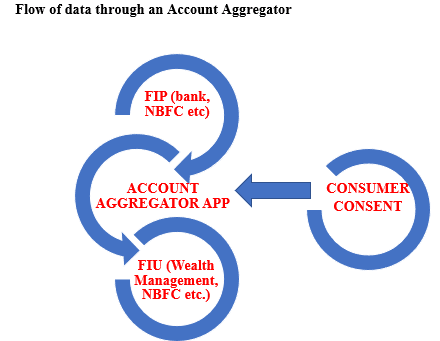

The AAs are data-blind consent custodians or the financial data access fiduciary which facilitate consent-based sharing of financial information in real-time between the Financial Information Providers (FIPs) and the Financial Information Users (FIUs). In simpler terms, these AAs act as intermediaries which transfer data from one financial entity such as banks, NBFCs etc. and transfer it to another financial entity without peeping into the financial data. This, however, is dependent on consent of the consumer.

The FIPs are data fiduciaries like banks, NBFCs, pension fund repository etc., and they hold customer data. The FIUs are the users of such financial information and include NBFCs, personal finance management, wealth management etc.

Objective of AA framework

The objective of AAs is to assist data sharing in a safe and secure manner, and to provide greater autonomy to users over their data. Through this, the AA framework will be able to better collate financial data spread across various financial entities and share it with financial entities using this data or the FIUs.

What information can be shared through AA framework?

The master direction on AA by the RBI specifies that only “financial assets” data transfer can be facilitated by the AAs. There are 19 categories of financial assets as defined by the master direction which includes deposits with banks and NBFCs, Systematic Investment Plans (SIPs), government securities etc.

Early use cases of the AA framework

The industry is looking forward to early use cases of the AA framework including its role in leveraging digital footprints of MSMEs purchases and payments, taxes and invoices etc. for accessing credit. Another possible use case could be an AA platform able to provide a user with her combined statement of transactions from all her bank accounts. A few early use cases of the AA framework include:

- Lending: The AA framework shall allow certain segments like MSMEs to access formal credit by helping in processing loan faster due to data flow in real-time. Access to MSME’s financial data will also enable FIUs to customize loans.

- Wealth management: One of the proposed use cases of the AA framework is wealth management wherein a user can give recurring consent to an AA to share her data with the wealth manager i.e. FIU. This shall enable easy access of data to the wealth manager, and the user will not have to share her FIP credentials with the wealth manager.

How will the AA framework revolutionize financial services?

Currently, the financial data of users remains in silos with various financial entities requiring the consumers to share it multiple times with multiple entities. The AA framework intends to bridge this gap by providing a consent-based mechanism wherein such financial information can be shared between FIUs and FIPs.

The AA framework facilities and provides:

- autonomy to users to control which FIU gets access to their data, track and logs it, and minimizes the data leakage risks through end-to-end encrypted data transfer.

- is user friendly and provides one window for all data movement especially at a time when physical movement is restricted due to the pandemic.

- access to reliable datasets of potential borrowers (informational collateral) including Micro, Small and Medium Enterprises (MSMEs) which could be leveraged for formal credit instead of furnishing a physical collateral. This has a potential of eliminating chances of fraud as data will be shared directly between the FIPs and FIUs instead of physical handling of documents by the consumer.

We are closely tracking the development of the AA ecosystem. For more information and policy suggestions on this topic, do write to apurva@nasscom.in.

Recommended readings:

- FAQs, Sahmati.

- Atreya Arun & Neeti Bhatt, Credit where credit is due- Enabling MSME businesses through the AA framework, D91labs

- Sahil Kini, Neeti Bhatt, Account aggregators could help the country democratize credit, LiveMint.

- Vikas Kathuria, Data Empowerment and Protection Architecture: Concept & Assessment, ORF Issue Brief No. 487, August 2021, Observer Research Foundation.